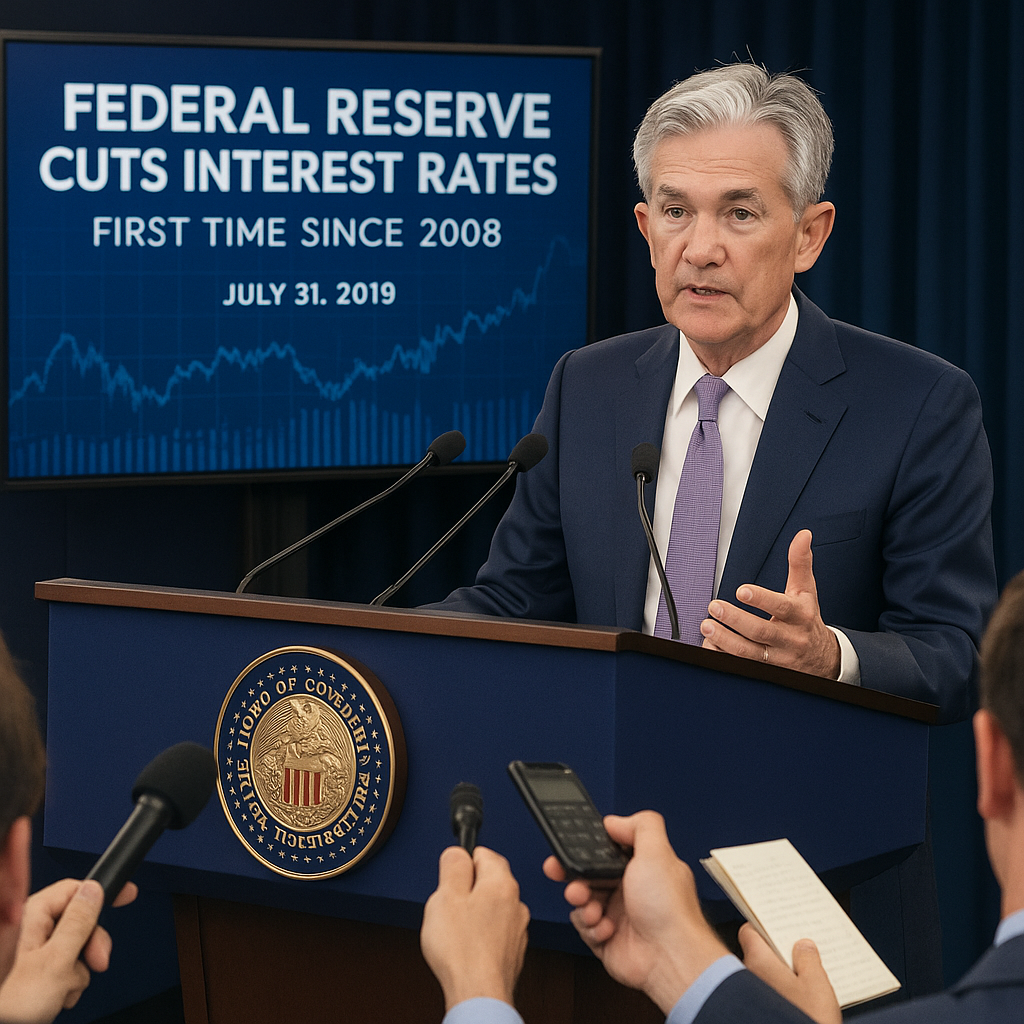

Federal Reserve Cuts Interest Rates for the First Time Since 2008

On July 31, 2019, the Federal Reserve announced a 25 basis point interest rate cut, lowering the target range for the federal funds rate to 2.00%–2.25%. This move marked the first rate reduction since the 2008 financial crisis, and signaled a significant shift in U.S. monetary policy amid a slowing global economy and mounting trade tensions.

While the Fed framed the cut as a “mid-cycle adjustment”, markets viewed it as a precautionary response to growing risks — from sluggish global growth to the escalating U.S.-China trade war and subdued inflation expectations.

Why Did the Fed Cut Rates?

Chairman Jerome Powell emphasized that the move was not the start of an extended easing cycle, but rather a “risk management” action to sustain the economic expansion.

Several key factors drove the decision:

1. Slowing Global Growth

The International Monetary Fund (IMF) had recently downgraded its global growth forecast for 2019 to 3.2%, citing weakness in manufacturing, Brexit uncertainty, and trade disruptions.

2. Trade War Pressures

Ongoing tensions between the U.S. and China had caused volatility in financial markets, disruptions in global supply chains, and hesitation in business investment.

3. Low Inflation

Despite record-low unemployment, core inflation remained below the Fed’s 2% target, raising concerns about long-term inflation expectations becoming unanchored.

4. Yield Curve Flattening

Parts of the yield curve had inverted earlier in 2019, which historically precedes recessions. A rate cut was seen as a way to steepen the curve and restore confidence.

Market Reactions

The immediate reaction was mixed and volatile:

-

Equities: The S&P 500 initially rallied but reversed as Powell’s comments were interpreted as less dovish than expected.

-

Bonds: Treasury yields fell slightly, reflecting expectations of further easing.

-

Dollar: The U.S. dollar strengthened, surprising some analysts who had expected it to weaken after the cut.

-

Gold: Prices rose briefly, then stabilized, as markets assessed whether this would become a longer easing cycle.

Investors had priced in multiple cuts for 2019. Powell’s insistence that this was not the beginning of a prolonged series caused some disappointment.

What It Means for the U.S. Economy

The Fed’s decision reflects the fragile balance policymakers are trying to strike:

-

Consumer spending remains strong, buoyed by low unemployment and rising wages.

-

Business investment has stalled, largely due to trade uncertainty.

-

Housing activity showed signs of rebounding, aided by lower mortgage rates.

By cutting rates, the Fed aimed to support confidence, lower borrowing costs, and sustain momentum in a late-cycle expansion.

Global Impact

The Fed’s rate cut had ripple effects across the world:

1. Emerging Markets

Lower U.S. rates often support emerging market assets by easing capital outflows and improving debt servicing in dollar-denominated bonds.

2. Central Bank Easing Cycle

Other central banks followed suit or signaled dovish intentions:

-

European Central Bank (ECB) indicated more stimulus was coming.

-

Reserve Bank of Australia and Bank of Korea had already cut rates in 2019.

-

People’s Bank of China (PBoC) hinted at further loosening.

3. Global Liquidity Boost

The move fed into the broader narrative of a global shift toward easier monetary policy, aiming to extend the economic cycle in the face of synchronized slowdown.

Criticism and Political Pressure

President Donald Trump had repeatedly pressured the Fed to cut rates more aggressively. After the July decision, he tweeted that the cut was “not enough” and blamed Powell for lacking boldness.

Some economists, however, warned against caving to political demands, and questioned whether monetary tools are sufficient to counter trade policy shocks or structural slowdowns.

Others feared the cut might inflate asset bubbles or signal panic — sending mixed messages to businesses and consumers.

Looking Ahead: More Cuts Coming?

By mid-July 2019, futures markets had priced in at least one more cut by year-end. Whether or not the Fed continues down that path depends on key data points:

-

Inflation trends: A further drop could pressure the Fed to act again.

-

Job growth and wages: If labor markets weaken, cuts may resume.

-

Trade negotiations: A resolution could reduce the need for easing.

-

Consumer confidence: A drop here would raise red flags for recession risk.

As Powell stated, the Fed will remain “data dependent”, ready to adjust if downside risks materialize.

Conclusion

The Federal Reserve’s rate cut in July 2019 was a historic pivot — the first since the depths of the 2008 crisis. While not the start of a prolonged easing cycle (at least officially), it reflected rising concern over global headwinds and the desire to shield the U.S. economy from future shocks.

For investors and policymakers alike, the move underscored that even in a long expansion, vigilance — and flexibility — are essential.