Inflation Slows, But Fed Remains Cautious

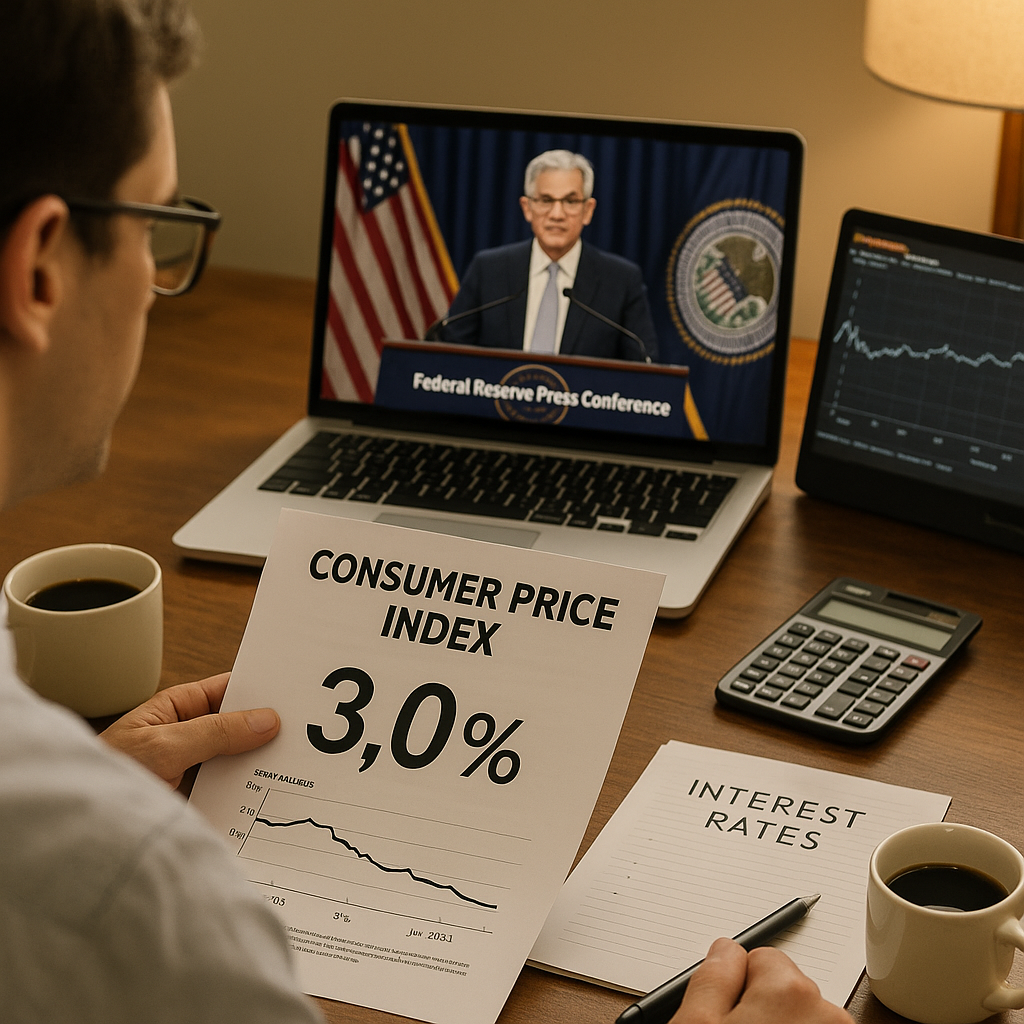

In July 2023, the U.S. economy received a dose of encouraging news: inflation is continuing to cool. According to the latest Consumer Price Index (CPI) data released on July 12th, annual inflation fell to 3.0%, marking the slowest pace since early 2021. Core inflation, which excludes volatile food and energy prices, also dipped slightly to 4.8%.

Markets welcomed the news — but the Federal Reserve wasn’t ready to declare victory. Despite the deceleration, policymakers signaled that interest rate hikes may not be over, warning that inflation is still well above the 2% target and that underlying pressures remain persistent.

Let’s unpack what this cooling inflation means for monetary policy, how markets are reacting, and what investors should watch in the second half of 2023.

Inflation: The Trend Is Encouraging

The headline CPI for June (released in July) showed continued disinflation:

-

Annual inflation: 3.0%, down from 4.0% in May and 6.5% at the start of the year.

-

Core CPI: 4.8%, down modestly from 5.3% in May.

Key areas contributing to the slowdown include:

-

Energy prices, which have dropped nearly 17% year-over-year.

-

Used car prices, which have reversed gains from early 2022.

-

Shelter costs, which are finally showing signs of plateauing.

The Federal Reserve’s aggressive rate hikes throughout 2022 and 2023 are having a visible impact on consumer demand, lending, and pricing power across sectors.

Why the Fed Remains Hawkish

Despite the positive CPI report, Fed officials have been quick to temper optimism. In a press conference following the release, Chair Jerome Powell reiterated that the fight against inflation isn’t over, noting:

“We are encouraged by recent data, but it’s too early to declare a turning point. We remain committed to restoring price stability.”

The Fed’s preferred inflation gauge, the Core PCE (Personal Consumption Expenditures), remains stickier than CPI — still hovering near 4.6%.

Several factors are keeping the Fed cautious:

-

Labor markets remain tight, with unemployment at 3.6% and wage growth still strong.

-

Core services inflation, particularly in housing and healthcare, continues to rise.

-

Consumer spending is surprisingly resilient, suggesting demand hasn’t softened enough.

In short: The Fed doesn’t want to repeat the mistake of 1970s-style premature easing, where inflation rebounded after early policy retreats.

Interest Rate Outlook: One More Hike?

As of mid-July, markets are pricing in a near-certain 25 bps hike at the July 26 FOMC meeting, which would push the federal funds rate to 5.25–5.50%, the highest in 22 years.

Beyond that, opinions diverge:

-

Dovish View: If inflation continues to fall and the job market weakens, this could be the final hike, with rate cuts possible in early 2024.

-

Hawkish View: The Fed may signal another hike in Q3, especially if core inflation proves stubborn or commodity prices rebound.

In Powell’s words: “We will be data-dependent — but we are not done yet.”

How Are Markets Reacting?

The July CPI report triggered a burst of optimism across asset classes:

Stocks

-

The S&P 500 rose above 4,500 for the first time since April 2022.

-

Tech stocks led gains, with the Nasdaq surging as lower inflation improves the outlook for growth companies.

-

Sectors like consumer discretionary and real estate also rallied.

Bonds

-

Treasury yields declined modestly, with the 10-year yield slipping to 3.75%.

-

Traders are increasingly pricing in fewer future hikes, though rate cut expectations remain muted.

Crypto

-

Bitcoin rebounded above $31,000, as easing inflation boosted risk appetite.

-

Ethereum and altcoins followed, with modest single-digit gains.

Commodities

-

Oil prices have stabilized, with WTI crude holding near $75/barrel — still far below 2022 highs, contributing to cooling headline inflation.

What It Means for Investors

The disinflation trend in mid-2023 presents both opportunity and complexity. Here’s how investors are approaching the current environment:

Stay Diversified

With inflation trending down but the Fed still active, balanced portfolios with exposure to equities, bonds, and alternative assets are key.

Watch Real Rates

As inflation falls faster than nominal yields, real interest rates are rising, which can support the dollar but pressure gold and some equities.

Growth Stocks Regain Favor

Lower inflation improves the outlook for long-duration assets, especially tech, biotech, and innovation sectors.

Don’t Ignore Fixed Income

Bonds are becoming attractive again — particularly short- to medium-duration Treasuries, which now offer solid yields with reduced inflation risk.

Remain Flexible

Volatility remains a threat, especially if geopolitical risks, supply shocks, or unexpected labor market data arise.

What to Watch in Q3 and Beyond

July 26 FOMC Meeting

All eyes are on whether the Fed will raise rates again and what forward guidance Powell offers.

Core Inflation Momentum

Will core services and shelter costs continue to decline? This is key for future Fed decisions.

Labor Market Shifts

Any signs of weakening job growth or wage softening could pivot policy in a dovish direction.

Geopolitical Factors

Developments in Ukraine, China-U.S. trade tensions, or global energy markets could shift inflationary dynamics quickly.

Final Thoughts: Soft Landing in Sight?

The July 2023 inflation data brings renewed hope that the U.S. economy may be on track for a soft landing — where inflation normalizes without triggering a deep recession. But the path remains narrow.

For now, the Fed is walking a tightrope: recognizing progress while staying vigilant. Investors should do the same — stay nimble, data-driven, and diversified as this critical monetary cycle unfolds.