Ethereum Implements Major Scalability Upgrade

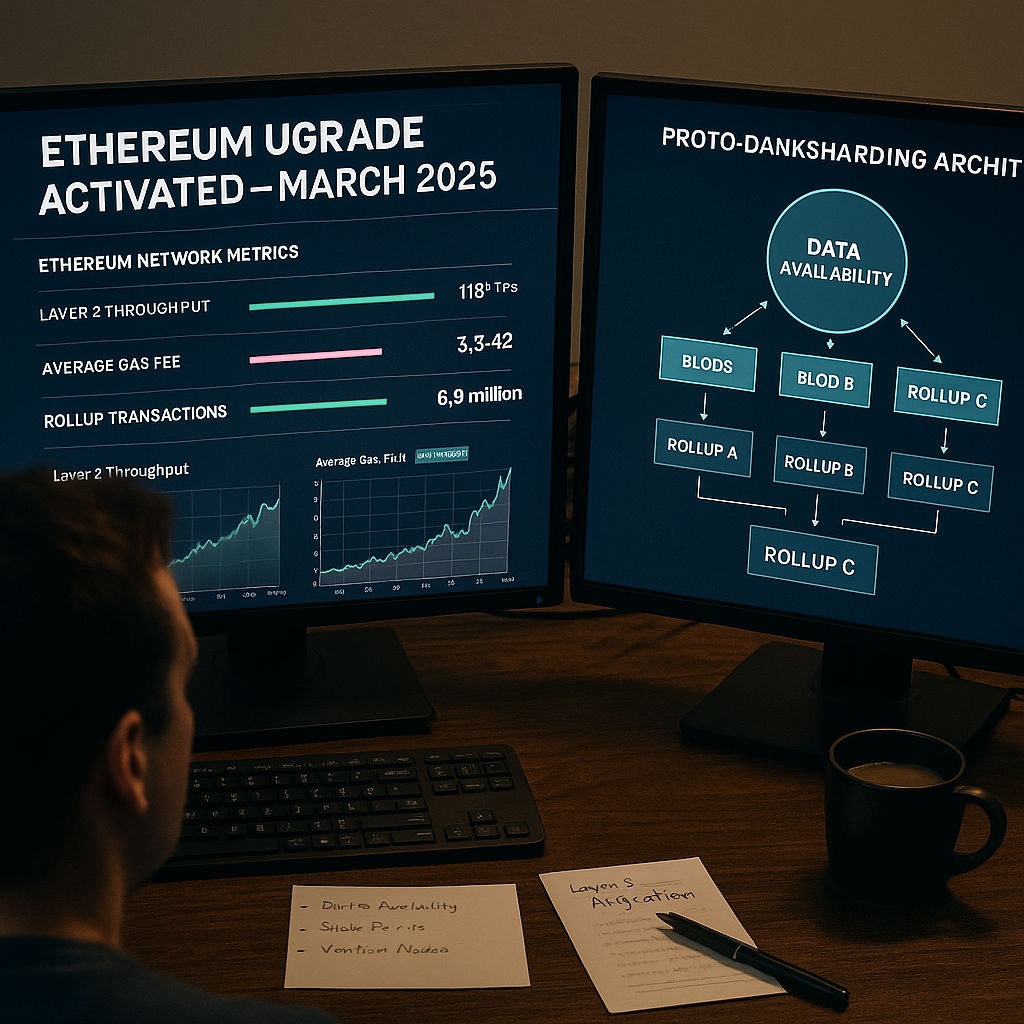

On March 13, 2025, Ethereum officially activated its long-awaited “Pectra” scalability upgrade, marking a transformative step toward resolving long-standing issues with transaction throughput, Layer 2 costs, and network efficiency. The upgrade includes proto-danksharding — a technical advancement that drastically reduces the cost of data availability on Layer 2 chains.

This milestone represents the most significant infrastructure leap since the 2022 Merge and the 2023 Shapella upgrade. Ethereum is now well-positioned to support the next generation of decentralized applications (dApps), institutional adoption, and real-world asset tokenization.

Why This Upgrade Matters

Ethereum has long faced criticism over:

-

High transaction fees

-

Slow block finality during congestion

-

Limited capacity for mainstream applications

The Pectra upgrade, which includes EIP-4844 (proto-danksharding), directly addresses these bottlenecks by introducing blobs — large, cheap data containers used by rollups for scalable execution.

Key results of this upgrade:

-

Layer 2 fees dropped by over 90%

-

Network bandwidth for rollups increased significantly

-

Data availability costs cut to a fraction of previous levels

-

Improved UX for games, DeFi, NFTs, and social apps

What Is Proto-Danksharding?

Proto-danksharding is the first step toward full danksharding, Ethereum’s long-term vision for horizontal scalability.

How it works:

-

Introduces “blobs”: large chunks of temporary data that Layer 2s can publish alongside regular transactions

-

These blobs are not stored permanently on Ethereum but remain available long enough for rollups to process

-

Validators and clients are upgraded to handle blob propagation efficiently

The result? Ethereum now functions as a more efficient data layer for rollups — unlocking scalability without sacrificing decentralization.

Immediate Impact on the Ecosystem

| Metric | Pre-Upgrade | Post-Upgrade |

|---|---|---|

| Average L2 Swap Fee | $0.48 | $0.03 |

| Average NFT Minting Cost (L2) | $0.92 | $0.07 |

| Daily Rollup Transactions | 5.1 million | 7.8 million |

| L2 Share of Total Ethereum Tx | 62% | 79% |

Platforms like Arbitrum, Optimism, Base, and zkSync have already integrated blob support, allowing dApps to pass savings directly to users. Meanwhile, developers are exploring new UX paradigms made viable by low-fee environments.

Reactions from the Community

Developers

Many app teams have restarted projects previously shelved due to gas costs:

-

Gaming studios are launching real-time multiplayer games on rollups

-

SocialFi platforms like Farcaster and Lens Protocol see daily active usage spike

-

Builders praise the predictable cost structure now enabled by blobs

Users

Retail users are thrilled with the performance shift:

-

Onboarding is faster with near-zero wallet creation costs

-

Cross-chain bridges using Layer 2s feel smoother and more affordable

-

Gas fee anxiety — a long-time Ethereum pain point — has significantly diminished

Ethereum’s Roadmap: What’s Next?

The Pectra upgrade paves the way for several follow-ups in Ethereum’s long-term plan:

1. Full Danksharding (2026)

-

Introduction of multiple data shards

-

Increased number of blobs per block

-

Maximum scalability for rollup-centric Ethereum

2. Verkle Trees

-

Optimized state storage, reducing node hardware requirements

-

Enables stateless clients for improved decentralization

3. Single-Slot Finality

-

Targeting near-instant finality

-

Improves user confidence and UX for global financial applications

Together, these upgrades will make Ethereum one of the most efficient and decentralized computation layers on the planet.

Competitive Implications

Ethereum’s rivals — including Solana, Avalanche, Aptos, and Sui — have spent years competing on speed and fees. But Ethereum’s Layer 2-centric approach now allows it to:

-

Scale linearly with demand

-

Maintain decentralization and security

-

Enable application-specific rollups, fine-tuned to particular use cases

This reduces the competitive advantage of “monolithic chains,” and reaffirms Ethereum’s position as the dominant Layer 1 ecosystem.

Institutional and Enterprise Interest

Lower costs and faster execution are attracting new attention from enterprises:

-

Tokenized treasuries and RWAs can now settle with minimal gas

-

Supply chain applications and CBDC pilots can move to Ethereum L2s

-

Compliant DeFi platforms are testing EVM-compatible frameworks for secure lending and payments

Major banks and fintechs are also evaluating private rollups, using Ethereum as the consensus and settlement layer.

DeFi and Consumer Apps Reignite

With scalability unlocked, developers are building for mass adoption again:

-

DeFi UX now feels like Web2, with near-zero swap fees

-

Mobile dApps have grown more feasible, especially in emerging markets

-

On-chain social networks, file storage, and AI agents are gaining traction

Protocols like Uniswap, Aave, and Friend.tech have announced blob-compatible upgrades, improving speed and gas optimization.

Potential Risks and Challenges

While the upgrade has been smooth so far, key risks remain:

-

L2 fragmentation: Multiple rollups may lead to liquidity silos and UX confusion

-

Blob congestion: If blobs fill too quickly, users may compete for availability space

-

MEV concerns: While blobs reduce costs, they may introduce new front-running vectors

However, ongoing research and community governance are actively addressing these dynamics.

Conclusion: Ethereum’s Scalability Era Has Begun

With the Pectra upgrade and proto-danksharding now live, Ethereum enters a new chapter — one where mass adoption is no longer constrained by gas fees or throughput limits.

Builders, users, and institutions alike now have a reliable, scalable, and secure foundation to deploy truly global applications — from AI agents to DeFi, from NFTs to public infrastructure.

2025 may be remembered not just as the year of crypto recovery, but as the moment Ethereum became scalable enough for the world.